Investors are often motivated by the search for the "next big thing," even if that means investing in high-risk "story stocks" with no revenue or profit. However, as renowned investor Peter Lynch once said in One Up On Wall Street, “Long shots almost never pay off.” Investing in loss-making companies can be a risky endeavor, as these businesses race against time to achieve financial stability. On the other hand, many prudent investors prefer to focus on companies like Corpay (NYSE: CPAY), which not only generates revenue but is also profitable. While this doesn’t necessarily make it the best investment opportunity, profitability is a crucial factor in evaluating long-term success.

A Closer Look at Corpay's Growth

One of the key indicators experienced investors monitor is earnings per share (EPS). If a company can sustain EPS growth over time, its stock price should eventually reflect that. Corpay’s performance is notable in this area, with EPS growing by 16% annually over the past three years—an impressive pace that suggests solid future potential if it can be maintained.

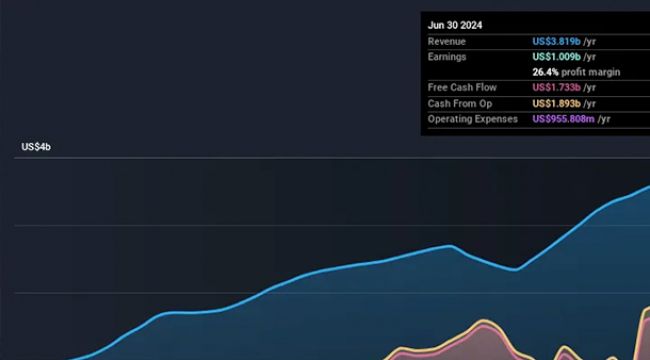

Looking at the company’s overall financial health, Corpay reported a revenue increase of 5.3% over the last year, reaching US$3.8 billion. While its earnings before interest and taxation (EBIT) margins remained stable, this revenue growth is a positive sign for the company’s profitability and continued expansion.

Are Insiders Aligned with Shareholders?

Given Corpay's size, it's reasonable to assume that insiders don’t own a significant portion of the company. However, it's encouraging to see that they still hold a substantial stake, with their investments valued at approximately US$756 million. This shows that management is financially committed to the company’s success, a reassuring factor for shareholders looking for leadership alignment with investor interests.

Additionally, a quick review of the CEO’s compensation reveals that Corpay’s executive remuneration is in line with industry standards. With a total median compensation of around US$13 million for CEOs in companies with market caps exceeding US$8 billion, Corpay’s leadership seems well-compensated but not excessively so, reinforcing the sense that shareholders’ interests are being considered.

In summary, Corpay’s profitability, steady growth in EPS, and insider investment make it a stock worth watching. Though it may not be the next big thing, it certainly shows signs of solid, sustainable progress.

COMMENTS